Customer Risk Scoring

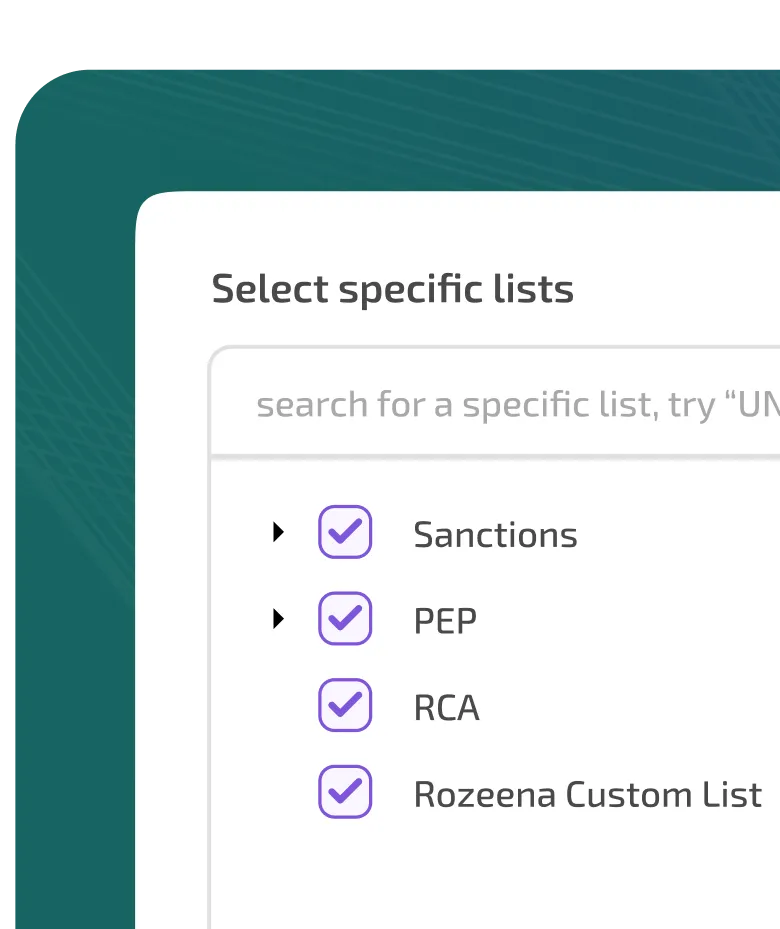

Assess risks accurately with our customizable Rule Builder tool that ensures alignment with both industry standards and your unique needs.

.svg)

.svg)

.svg)

Risk Scoring Tailored to Your Needs

1

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

8

7

6

5

4

3

2

1

.svg)

Intelligent Risk Management

Continue to refine your onboarding with other products

Empower Proactive Financial Strategies

Risk Avoidance

Mitigate risks by safeguarding your operations and making data-driven decisions during customer onboarding.

Adaptive Compliance

Stay ahead of regulatory changes with our Rule Builder, ensuring effortless compliance in the dynamic financial landscape.

Real-Time Awareness

Get instant alerts and updates on changes to customer risk score to make accurate data-driven decisions with confidence.

Frequently asked questions

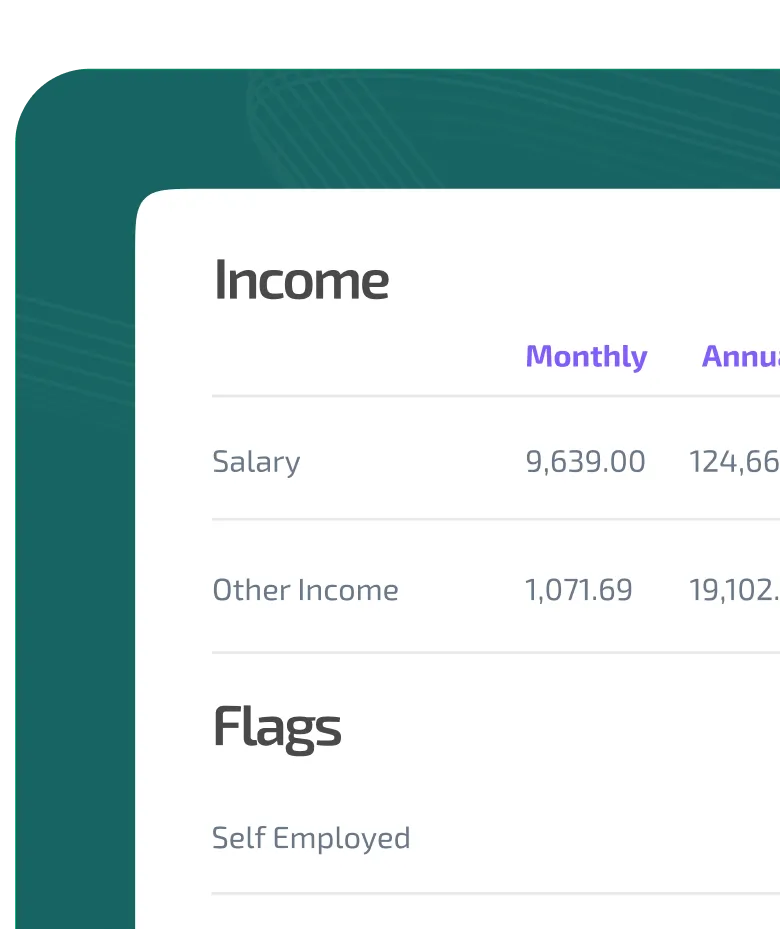

How does Customer Risk Scoring work?

Based on a customer’s profile, information and a set of predefined rules we can use our AI technology to estimate an accurate score that represents the risk of onboarding this customer. Additionally you can determine which rules hold more value in terms of scoring through our customizable rule builder.

Can I hand pick specific products?

Yes, FOCAL customizable platform capabilities enables a tailored Verification and KYC/KYB solution to our client’s unique needs and risk profiles. Allowing you to select what products and features they need.

How can I integrate?

We understand the complexity of different organization’s goals, timelines and infrastructure. Hence FOCAL is built around the concept of adaptability. Choose what works best for you, integrate our technology through API to enable auto-sync with internal systems or simply adopt our user friendly UI for instant functionality.

Why is onboarding important for my business?

Proactivity is your best defense. By staying ahead during your onboarding process, you not only enhance operational efficiency by introducing automation and improving customer experience but also combat fraud and maintain AML compliance in a constantly evolving environment. This approach solidifies your organization's reputation and strengthens customer trust.

Is onboarding with FOCAL compliant with industry regulations?

Absolutely, FOCAL is designed to adhere to industry standards and regulatory requirements, helping you maintain compliance and avoid potential legal repercussions.

.png)

.webp)

.svg)

%20(1).webp)